Beat the Money Blues: 5 Investment Strategies

Do you find yourself feeling overwhelmed by the rising cost of living and the constant threat of inflation? It can be easy to feel discouraged when it seems like your hard-earned money is losing its value faster than you can earn it. But fear not! There are smart investment strategies you can implement to outpace inflation and secure your financial future.

1. Diversify Your Portfolio

One of the most effective ways to beat inflation is to diversify your investment portfolio. By spreading your investments across different asset classes such as stocks, bonds, real estate, and commodities, you can reduce the risk of losing money when one sector underperforms. Diversification also allows you to take advantage of opportunities for growth in different markets, helping you stay ahead of inflation.

2. Invest in Real Assets

Inflation erodes the purchasing power of your money, making it crucial to invest in assets that typically appreciate in value over time. Real assets such as real estate, precious metals, and collectibles have historically outpaced inflation and provided investors with a hedge against rising prices. By allocating a portion of your portfolio to real assets, you can protect your wealth and potentially earn higher returns.

3. Focus on Dividend-Paying Stocks

Dividend-paying stocks can be a valuable addition to your investment strategy, especially during times of inflation. Companies that consistently pay dividends tend to be more stable and resilient in volatile market conditions, making them a reliable source of income for investors. By reinvesting dividends or using them to purchase additional shares, you can benefit from compounding returns and outpace inflation over the long term.

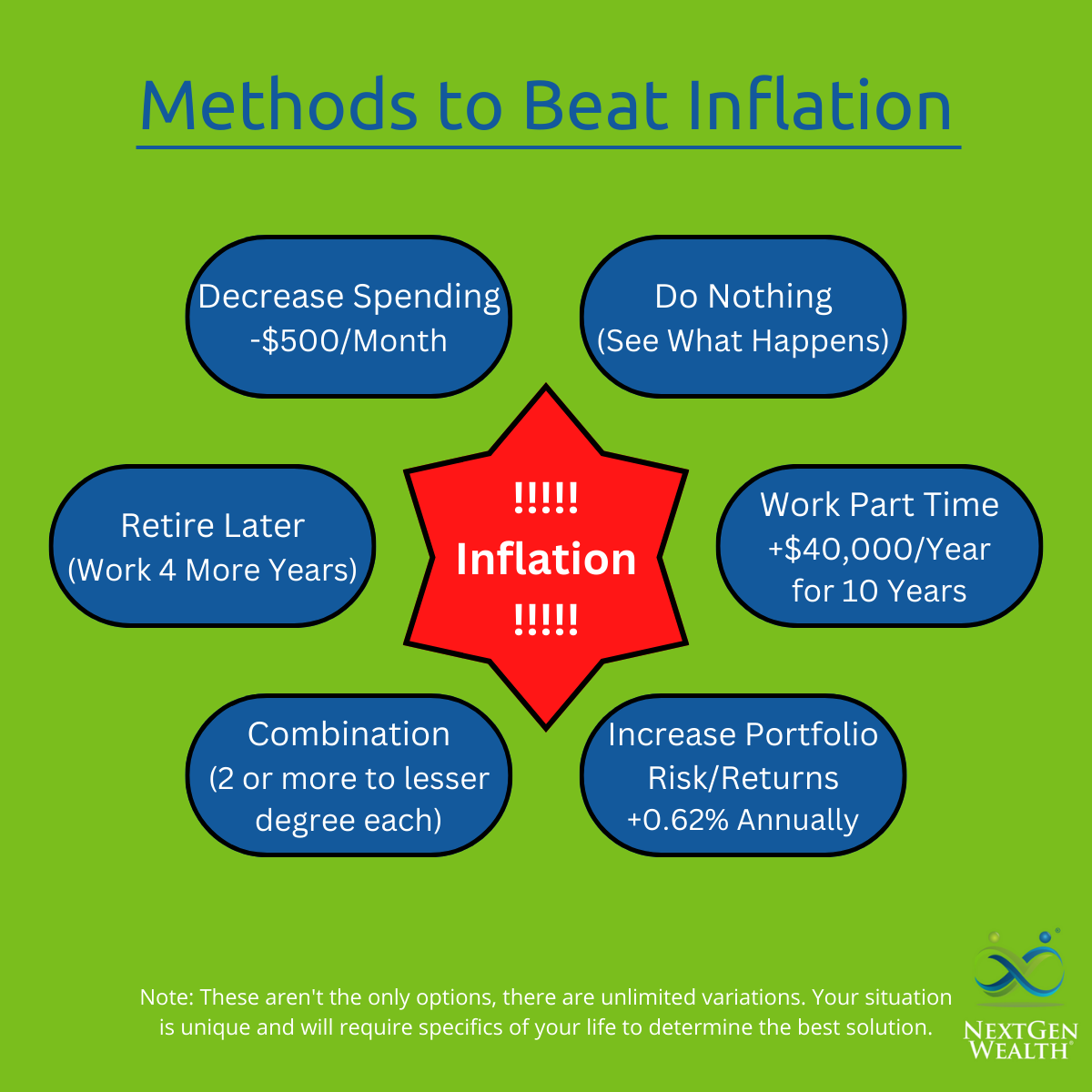

Image Source: nextgen-wealth.com

4. Consider Inflation-Protected Securities

Inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), are specifically designed to safeguard investors against the negative effects of inflation. These bonds adjust their principal value in line with changes in the Consumer Price Index (CPI), ensuring that investors receive a consistent real return on their investment. By including TIPS in your portfolio, you can mitigate the impact of inflation and preserve the purchasing power of your money.

5. Stay Active and Stay Informed

Inflation is a constant threat to your financial well-being, so it’s essential to stay active and informed about market trends and economic developments. Keep track of inflation rates, interest rates, and other key indicators that can impact your investments. By staying proactive and adjusting your investment strategy as needed, you can adapt to changing market conditions and position yourself for long-term success.

In conclusion, beating the money blues and outpacing inflation requires a strategic approach to investing. By diversifying your portfolio, investing in real assets, focusing on dividend-paying stocks, considering inflation-protected securities, and staying active and informed, you can build a resilient investment strategy that withstands the challenges of inflation. Remember, the key to financial success is to stay disciplined, stay proactive, and always be prepared to adapt to the ever-changing financial landscape.

Stay Ahead of Inflation with These Smart Tips!

Inflation is a constant concern for investors looking to grow their wealth over the long term. As prices rise, the purchasing power of your money decreases, making it essential to find smart investment strategies to outpace inflation. Here are five tips to help you stay ahead of inflation and protect your wealth:

1. Invest in Real Assets: One of the most effective ways to outpace inflation is to invest in real assets such as real estate, precious metals, and commodities. These assets tend to hold their value over time, making them a good hedge against inflation. Real estate, in particular, has historically been a reliable investment during inflationary periods, as property values tend to rise along with prices.

2. Consider Treasury Inflation-Protected Securities (TIPS): TIPS are a type of government bond that is specifically designed to protect investors from inflation. The principal value of TIPS increases with inflation and decreases with deflation, making them a safe and effective way to preserve your purchasing power. While the returns on TIPS may not be as high as other investments, they can provide a steady income stream and help you keep pace with rising prices.

3. Diversify Your Portfolio: Diversification is key to managing risk and outpacing inflation. By spreading your investments across different asset classes, sectors, and geographies, you can reduce the impact of inflation on your portfolio. A diversified portfolio can help you capture growth opportunities in various market conditions and minimize the effects of inflation on your overall wealth.

4. Invest in Dividend-Paying Stocks: Dividend-paying stocks can be a good way to generate income and outpace inflation. Companies that regularly pay dividends tend to be more stable and profitable, making them a reliable source of income during inflationary periods. Reinvesting dividends can also help you grow your wealth over time, as compound interest works its magic to increase your returns.

5. Stay Active and Stay Informed: Keeping a close eye on the market and staying informed about economic trends can help you make smart investment decisions to outpace inflation. By staying active in managing your portfolio and adjusting your investments based on market conditions, you can take advantage of opportunities to grow your wealth and protect it from the erosive effects of inflation.

By following these smart investment strategies, you can stay ahead of inflation and protect your wealth over the long term. Investing in real assets, TIPS, dividend-paying stocks, and diversifying your portfolio can help you outpace inflation and grow your wealth despite rising prices. Stay informed, stay active, and watch your wealth grow as you navigate the ever-changing investment landscape.

5 Investment Strategies That Beat Inflation