Millennial Money Moves: 7 Casual Investment Strategies!

As a millennial, investing can often seem intimidating and overwhelming. With so many options and strategies out there, it’s hard to know where to start. However, investing doesn’t have to be complicated or high-stress. In fact, there are plenty of casual investment strategies that every millennial should know about. These strategies can help you grow your wealth without the need for a suit and tie. So, let’s dive into the world of casual investing and explore seven money moves that every millennial should consider.

1. Start with a Robo-Advisor

One of the easiest ways to dip your toes into the world of investing is by using a robo-advisor. Robo-advisors are automated investment platforms that use algorithms to create and manage a diversified portfolio for you. They take the guesswork out of investing and make it easy for beginners to get started. With a robo-advisor, you can set your investment goals, risk tolerance, and timeline, and the platform will do the rest for you. It’s a hands-off approach that is perfect for busy millennials who don’t have the time or expertise to actively manage their investments.

2. Invest in Low-Cost Index Funds

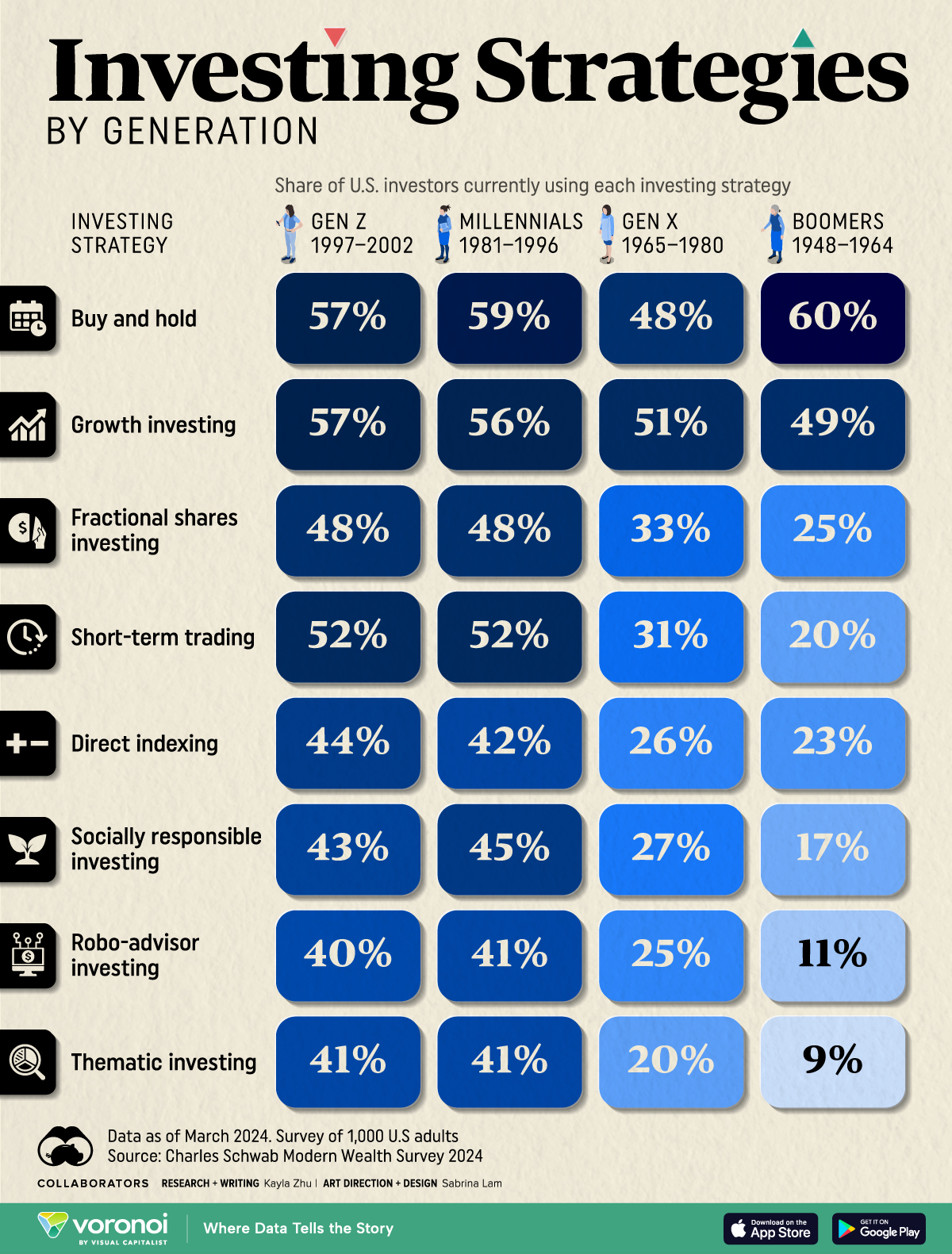

Image Source: visualcapitalist.com

Index funds are a type of mutual fund or exchange-traded fund (ETF) that tracks a specific market index, such as the S&P 500. These funds offer instant diversification and low fees, making them a great option for passive investors. By investing in index funds, you can gain exposure to a wide range of stocks or bonds without having to pick individual investments yourself. Plus, because index funds are passively managed, they typically have lower fees than actively managed funds, which can eat into your returns over time.

3. Consider Real Estate Crowdfunding

Real estate crowdfunding platforms allow investors to pool their money together to invest in real estate projects. This can be a great way to diversify your portfolio and gain exposure to the real estate market without the hassle of buying and managing properties yourself. With real estate crowdfunding, you can invest in a wide range of projects, from residential properties to commercial developments, all from the comfort of your own home. It’s a hands-off way to add real estate to your investment portfolio and potentially earn passive income.

4. Embrace Dividend Investing

Dividend investing is a strategy where investors buy stocks in companies that pay regular dividends to their shareholders. These dividends can provide a steady stream of income, which can be especially appealing to millennials looking for passive income opportunities. By reinvesting your dividends or using them to buy more shares, you can accelerate your wealth-building over time. Dividend investing is a great way to build a diversified portfolio of income-producing assets and grow your wealth in a consistent and predictable manner.

5. Try Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers with individual investors who are willing to lend them money in exchange for interest payments. This can be a great way to earn passive income and diversify your investment portfolio outside of the stock market. With peer-to-peer lending, you can lend small amounts of money to a diverse range of borrowers, spreading out your risk and potentially earning higher returns than traditional fixed-income investments. It’s a casual way to dip your toes into the world of lending and potentially earn a solid return on your investment.

6. Invest in Cryptocurrency

Cryptocurrency has taken the financial world by storm in recent years, and many millennials are jumping on the bandwagon. While cryptocurrency investing can be volatile and risky, it can also offer high potential returns for those willing to take the plunge. By investing in popular cryptocurrencies like Bitcoin or Ethereum, you can gain exposure to this emerging asset class and potentially earn significant profits if the market continues to rise. Just remember to do your research and only invest money that you can afford to lose when dabbling in the world of cryptocurrency.

7. Start a Side Hustle

One of the best ways to grow your wealth as a millennial is by starting a side hustle. Whether it’s freelancing, selling products online, or offering a service, a side hustle can provide you with an additional source of income that you can use to invest and build your wealth. By leveraging your skills and passions to create a side business, you can generate extra cash flow that can be put towards your investment goals. Plus, starting a side hustle can be a fun and fulfilling way to explore new opportunities and grow as an entrepreneur.

In conclusion, investing doesn’t have to be intimidating or high-stress. By exploring these casual investment strategies, every millennial can take control of their financial future and start building wealth in a fun and relaxed way. Whether you’re a beginner or an experienced investor, there are plenty of options out there to help you grow your wealth and achieve your financial goals. So, don’t be afraid to try out some of these money moves and see where they can take you on your journey to financial success.

Easy Ways to Grow Your Wealth – No Suit Required!

As a millennial, building wealth may seem like a daunting task. With student loan debt, rising living costs, and the pressure to keep up with social media standards, saving and investing can often take a backseat in our priorities. However, there are simple and casual investment strategies that can help you grow your wealth without the need for a stuffy suit and tie. Here are seven easy ways to start building your financial future:

1. Start with a High-Yield Savings Account

One of the easiest ways to grow your wealth is to open a high-yield savings account. These accounts offer higher interest rates than traditional savings accounts, allowing your money to grow faster over time. With minimal effort required, you can watch your savings grow steadily without having to actively manage your investments.

2. Invest in Index Funds

Investing in index funds is a great way to build wealth over the long term. These funds track the performance of a specific market index, such as the S&P 500, and offer diversification across a wide range of assets. With low fees and minimal maintenance required, index funds are a simple and effective way to grow your wealth without the need for constant monitoring.

3. Utilize Robo-Advisors

Robo-advisors are automated investment platforms that use algorithms to manage your portfolio based on your financial goals and risk tolerance. With low fees and no minimum investment requirements, robo-advisors are a convenient and hands-off way to grow your wealth without the need for extensive financial knowledge or expertise.

4. Take Advantage of Employer-Sponsored Retirement Plans

If your employer offers a 401(k) or similar retirement plan, be sure to take advantage of it. These plans often come with matching contributions from your employer, effectively giving you free money to grow your wealth. By contributing regularly to your retirement account, you can build a nest egg for the future without having to actively manage your investments.

5. Invest in Real Estate through REITs

Real Estate Investment Trusts (REITs) are a simple and accessible way to invest in real estate without the need for large amounts of capital or hands-on property management. By purchasing shares in a REIT, you can earn passive income through dividends and benefit from the appreciation of the underlying real estate assets.

6. Start a Side Hustle

Building wealth doesn’t have to be limited to traditional investment vehicles. Starting a side hustle can be a fun and rewarding way to grow your wealth while pursuing your passions. Whether it’s freelance writing, selling handmade crafts, or driving for a rideshare service, a side hustle can provide an additional source of income to boost your savings and investments.

7. Practice Mindful Spending

One of the simplest ways to grow your wealth is to practice mindful spending. By tracking your expenses, setting a budget, and prioritizing your financial goals, you can ensure that your money is being used effectively to build your wealth. By cutting back on unnecessary expenses and focusing on what truly matters to you, you can accelerate your journey toward financial independence.

In conclusion, growing your wealth doesn’t have to be a daunting or complex task. By incorporating these easy and casual investment strategies into your financial plan, you can start building a solid foundation for your future without the need for a suit and tie. With a little bit of effort and dedication, you can set yourself on the path to financial success and achieve your long-term goals.

Top 7 Investment Strategies for Millennials