Safeguarding Your Wealth: Beating the Inflation Blues

In today’s fast-paced world, it can be challenging to keep up with the ever-changing economic landscape. One of the biggest threats to your financial well-being is inflation. As prices rise, the value of your money decreases, making it crucial to find ways to protect your wealth from the effects of inflation.

So, how can you beat the inflation blues and safeguard your wealth? Here are some smart strategies to help you navigate the impact of inflation:

1. Diversify Your Investments: One of the most effective ways to protect your wealth from inflation is to diversify your investments. By spreading your money across a range of asset classes such as stocks, bonds, real estate, and commodities, you can reduce the risk of losing money when inflation strikes. Diversification helps you capitalize on the growth of different sectors while minimizing the impact of inflation on your overall portfolio.

2. Invest in Inflation-Protected Securities: Another way to beat the inflation blues is to invest in inflation-protected securities such as Treasury Inflation-Protected Securities (TIPS). These government-backed bonds are designed to adjust their principal value based on changes in the Consumer Price Index (CPI), ensuring that your investment keeps pace with inflation. By holding TIPS in your portfolio, you can preserve the purchasing power of your money and mitigate the impact of rising prices.

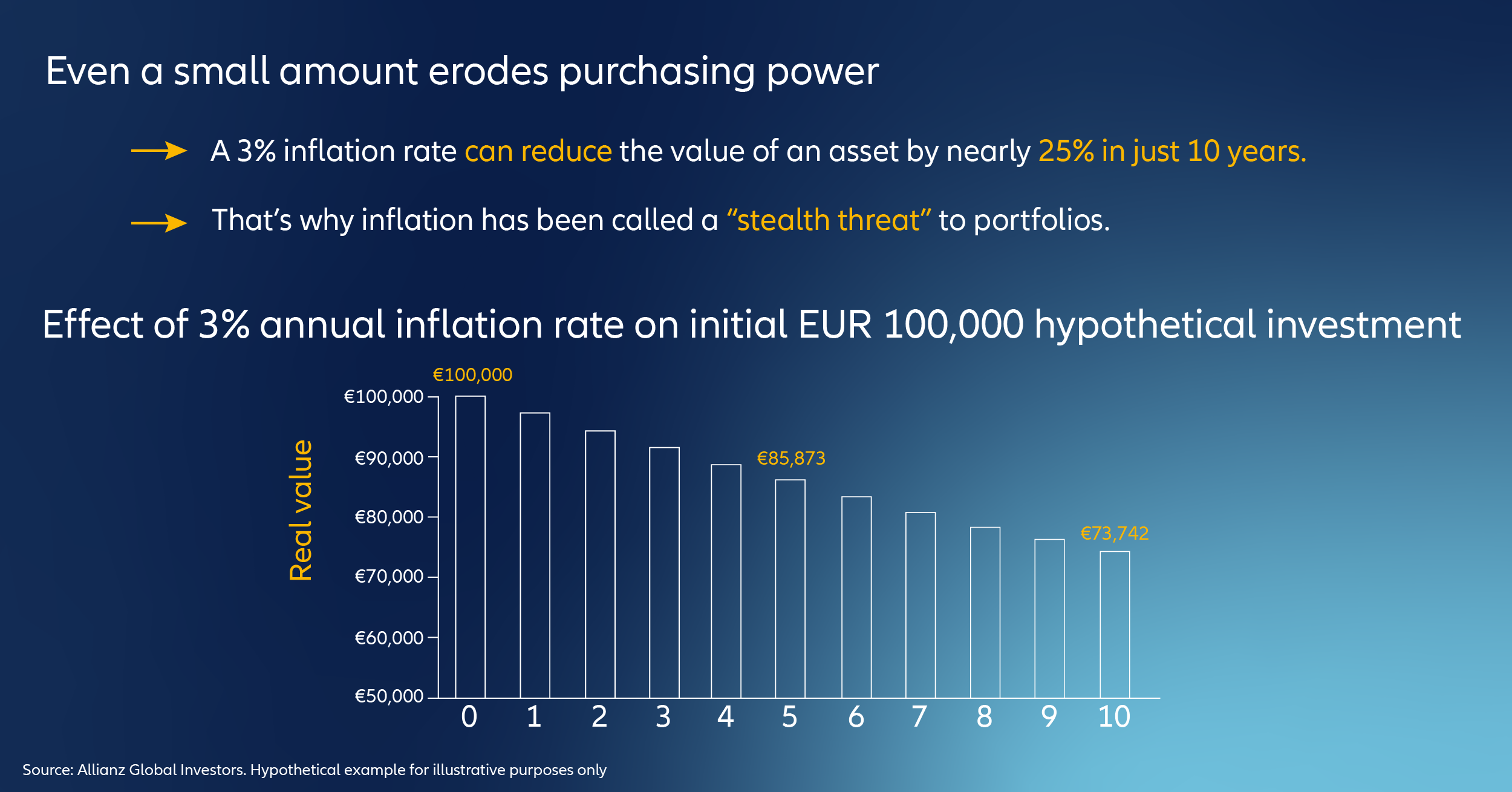

Image Source: allianz.com

3. Consider Real Assets: Real assets like real estate, gold, and other commodities can serve as a hedge against inflation. These tangible assets have intrinsic value that tends to rise with inflation, making them a valuable addition to your investment portfolio. By diversifying into real assets, you can protect your wealth from the erosion caused by inflation and potentially generate higher returns in the long run.

4. Focus on Dividend-Paying Stocks: Investing in dividend-paying stocks can also be a smart strategy for beating inflation. Companies that pay regular dividends tend to be more stable and mature, making them resilient in the face of economic uncertainties. By holding dividend-paying stocks in your portfolio, you can benefit from a steady stream of income that can help offset the impact of inflation on your wealth.

5. Rebalance Your Portfolio Regularly: To keep your investments safe from the effects of inflation, it’s essential to regularly rebalance your portfolio. As market conditions change, some assets may perform better than others, leading to an imbalance in your portfolio. By rebalancing your investments periodically, you can ensure that your portfolio remains diversified and aligned with your financial goals, helping you weather the impact of inflation over time.

6. Stay Informed and Seek Professional Advice: Finally, staying informed about economic trends and seeking professional advice can help you make informed decisions about your investments. Keeping up to date with market developments, inflation rates, and financial news can empower you to make strategic choices that protect your wealth from the challenges of inflation. Additionally, working with a financial advisor can provide you with personalized guidance and expertise to navigate the complexities of investing in a rapidly changing economic environment.

By implementing these smart strategies and staying proactive about safeguarding your wealth, you can beat the inflation blues and secure your financial future. Remember, the key to success is to diversify your investments, focus on assets that can withstand inflation, and stay informed about market trends. With the right approach, you can navigate the impact of inflation and protect your wealth for the long term.

Smart Strategies for Growing Wealth and Beating Inflation

In today’s fast-paced world, it’s more important than ever to ensure that your investments are protected from the impact of inflation. With prices constantly on the rise, the value of your money can quickly erode if you’re not careful. That’s why it’s crucial to have smart strategies in place to grow your wealth and beat inflation.

One of the most effective ways to protect your investments from the effects of inflation is to diversify your portfolio. By spreading your money across a range of different asset classes, you can reduce the risk of losing money when prices rise. This means investing in a mix of stocks, bonds, real estate, and other assets to ensure that your wealth is not tied to the performance of any single market.

Another key strategy for beating inflation is to focus on long-term growth rather than short-term gains. While it can be tempting to chase after quick profits, the most successful investors understand that building wealth takes time. By investing in solid, stable companies with strong growth potential, you can ride out market fluctuations and come out ahead in the long run.

It’s also important to keep an eye on the overall economic landscape and adjust your investment strategy accordingly. Inflation rates can vary significantly depending on factors such as government policy, global economic conditions, and consumer behavior. By staying informed and adapting to changes in the market, you can position yourself to take advantage of opportunities for growth while minimizing the impact of inflation on your wealth.

Another smart strategy for growing wealth and beating inflation is to consider investing in assets that have historically outperformed inflation. This could include commodities like gold and silver, which tend to hold their value well during times of economic uncertainty. Real estate is another popular choice for investors looking to hedge against inflation, as property values typically rise over time.

In addition to diversifying your portfolio and focusing on long-term growth, it’s also important to regularly review and rebalance your investments. Markets are constantly changing, and what may have been a sound investment strategy last year may no longer be the best approach today. By periodically reassessing your portfolio and making adjustments as needed, you can ensure that your investments remain well-positioned to weather the effects of inflation.

When it comes to keeping your investments safe in the face of inflation, knowledge is power. By staying informed about market trends, economic indicators, and investment opportunities, you can make informed decisions that will help you grow your wealth over time. Remember, the key to success is not just to protect your money from inflation, but to actively work towards growing your wealth even in the face of challenging economic conditions.

In conclusion, by employing smart strategies such as diversification, long-term growth focus, staying informed, investing in inflation-beating assets, and regularly reviewing your portfolio, you can navigate the impact of inflation and ensure that your investments remain safe and continue to grow over time. By taking a proactive approach to managing your investments, you can build a strong financial foundation that will serve you well in the years to come.

The Impact of Inflation on Your Investments and How to Protect Yourself