The Bright Side of Index Funds: A Beginner’s Guide

Index funds have gained popularity in recent years as a simple and effective way for beginners to start investing in the stock market. These funds offer a number of advantages that make them a valuable addition to any investment portfolio. In this beginner’s guide, we will explore the upsides of index funds and how they can benefit your overall investment approach.

One of the main advantages of index funds is their low cost. Unlike actively managed mutual funds, which often come with high fees and expenses, index funds are passively managed and aim to replicate the performance of a specific market index. This means that they have lower operating costs, which can translate to higher returns for investors in the long run.

Another upside of index funds is their diversification. By investing in an index fund, you are essentially buying a piece of the entire market. This means that your investment is spread out across a wide range of companies and industries, reducing the risk of any one particular stock underperforming. Diversification is key to managing risk in your investment portfolio, and index funds make it easy for beginners to achieve this.

Index funds also offer simplicity and convenience. With an index fund, you don’t have to worry about picking individual stocks or trying to time the market. Instead, you can simply buy into the fund and let it do the work for you. This passive approach is perfect for beginners who may not have the time or expertise to actively manage their investments.

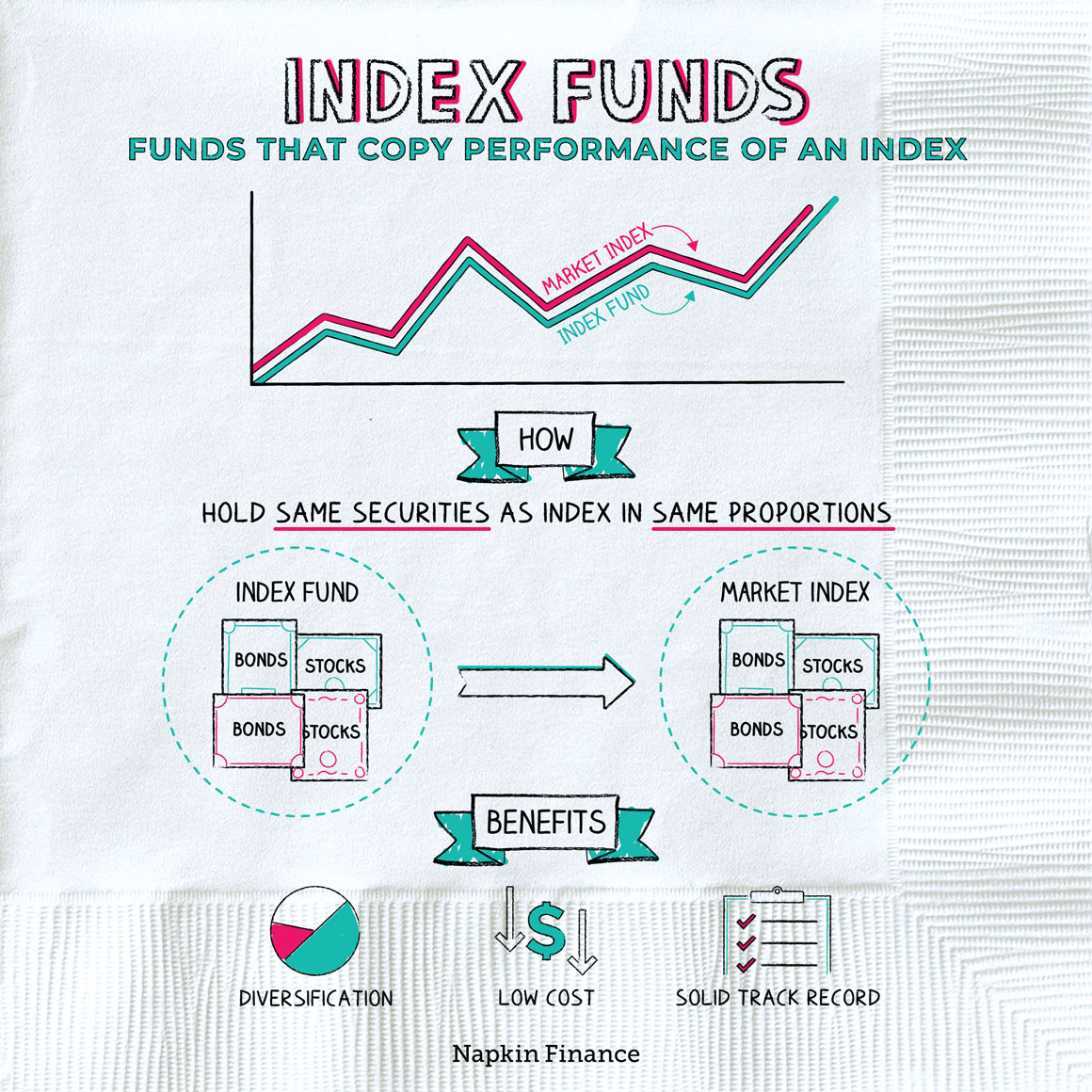

Image Source: napkinfinance.com

Furthermore, index funds are known for their transparency. Because they aim to replicate the performance of a specific index, the holdings of an index fund are typically disclosed on a regular basis. This means that investors know exactly what they are investing in and can track the performance of the fund over time. Transparency is important for building trust and confidence in your investment strategy.

In addition, index funds are tax-efficient. Because they have low turnover and turnover, they generate fewer capital gains, which can result in lower tax liabilities for investors. This can be especially beneficial for beginners who may not be familiar with the tax implications of their investments.

Finally, index funds have a history of outperforming actively managed funds over the long term. While it is true that some actively managed funds may outperform the market in the short term, research has shown that index funds tend to deliver more consistent returns over time. By investing in an index fund, you are essentially betting on the overall growth of the market, which has historically proven to be a sound investment strategy.

In conclusion, index funds offer a number of advantages for beginners looking to start investing in the stock market. From their low cost and diversification to their simplicity and transparency, index funds can be a valuable addition to any investment portfolio. By understanding the bright side of index funds, beginners can confidently incorporate them into their investment approach and work towards achieving their financial goals.

Navigating the Pitfalls of Index Funds with Confidence

If you’re new to the world of investing, you may have heard about index funds as a popular investment option. Index funds are a type of mutual fund or exchange-traded fund (ETF) that aims to replicate the performance of a specific market index, such as the S&P 500. While index funds offer several advantages, they also come with their own set of pitfalls that investors should be aware of. In this article, we will explore both the upsides and downsides of index funds in your investment approach to help you navigate them with confidence.

One of the main advantages of investing in index funds is their low cost. Because index funds are passively managed and aim to track a specific index, they typically have lower expense ratios compared to actively managed funds. This means that you can achieve broad market exposure at a fraction of the cost of other investment options. Additionally, index funds are known for their diversification benefits. By investing in an index fund, you are essentially investing in a basket of securities that represent a particular market segment, which can help reduce the risk of individual stock picking.

However, despite their benefits, index funds also have their pitfalls that investors should be aware of. One of the downsides of index funds is that they are not designed to outperform the market. Since index funds aim to replicate the performance of a specific index, they will never outperform the market. This means that if the market is performing poorly, your index fund will also reflect that performance. Additionally, because index funds hold a fixed set of securities that make up the index, there is a lack of flexibility in terms of adjusting the portfolio to take advantage of market opportunities or to mitigate risks.

Another pitfall of index funds is the risk of tracking error. While index funds aim to track a specific market index, there can be slight discrepancies between the performance of the fund and the actual index due to factors such as transaction costs, taxes, and management fees. These tracking errors can impact the overall return of the fund and may not accurately reflect the performance of the index it is supposed to track.

Furthermore, index funds may also lack the potential for high returns compared to actively managed funds. Since index funds aim to replicate the performance of a specific index, they are limited in their ability to outperform the market or generate higher returns through active management strategies. This can be a downside for investors looking to achieve above-average returns on their investments.

Despite these pitfalls, there are ways to navigate the downsides of index funds with confidence. One approach is to complement your index fund investments with other types of investments, such as individual stocks or actively managed funds, to diversify your portfolio and potentially enhance returns. By diversifying your investments across different asset classes, you can spread out risk and take advantage of different market opportunities.

Another way to navigate the pitfalls of index funds is to regularly review and rebalance your portfolio. Rebalancing involves adjusting the weights of different assets in your portfolio to maintain your desired asset allocation. By periodically rebalancing your portfolio, you can ensure that your investment strategy remains aligned with your financial goals and risk tolerance.

In conclusion, while index funds offer several advantages, they also come with their own set of pitfalls that investors should be aware of. By understanding the upsides and downsides of index funds in your investment approach, you can navigate them with confidence and make informed decisions to achieve your financial goals. Remember to diversify your investments, regularly review and rebalance your portfolio, and seek advice from a financial advisor if needed to make the most of your investment strategy.

The Pros and Cons of Index Funds in Your Investment Strategy