Shake Up Your Investments

When it comes to investing, many people tend to stick to what they know. They may have a comfortable portfolio of stocks and bonds that have served them well over the years. However, in order to truly maximize your investment potential, it’s important to shake things up and diversify your portfolio.

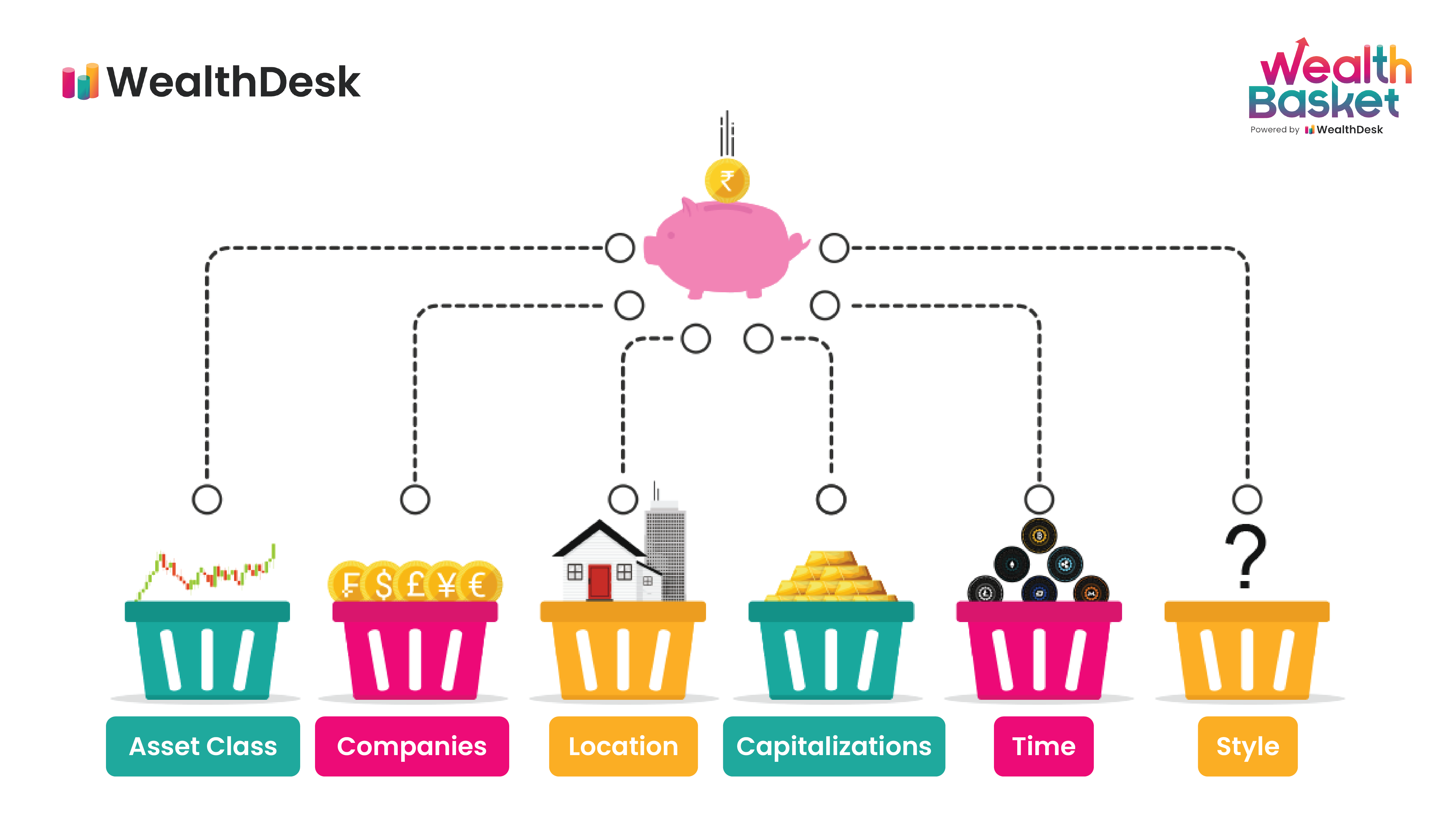

Diversifying your investment portfolio involves spreading your investments across different asset classes, industries, and geographic regions. This strategy helps to reduce risk and increase the likelihood of higher returns. By investing in a variety of assets, you can protect yourself from market fluctuations and potential losses in any one area.

One way to shake up your investments is to consider adding alternative investments to your portfolio. Alternative investments can include things like real estate, commodities, and even cryptocurrencies. These investments can provide a unique opportunity to diversify your portfolio and potentially earn higher returns than traditional investments.

Another way to shake up your investments is to consider investing in emerging markets. Emerging markets are countries that are experiencing rapid economic growth and industrialization. By investing in these markets, you can take advantage of potential high returns and diversify your portfolio across different economies.

Image Source: wealthdesk.in

It’s also important to consider mixing up the types of assets in your portfolio. Instead of just investing in stocks and bonds, consider adding other asset classes such as mutual funds, exchange-traded funds (ETFs), or even precious metals. By diversifying across different types of assets, you can further reduce risk and increase the potential for higher returns.

In addition to diversifying across different asset classes, it’s also important to consider diversifying across different industries. Investing in a variety of industries can help protect your portfolio from sector-specific risks. For example, if you have a large portion of your portfolio invested in tech stocks and the tech industry experiences a downturn, your entire portfolio could suffer. By diversifying across industries, you can mitigate this risk and potentially earn higher returns.

Geographic diversification is another important aspect of shaking up your investments. By investing in companies and assets from different geographic regions, you can protect your portfolio from country-specific risks. For example, if you have all of your investments in US-based companies and the US economy experiences a recession, your portfolio could suffer. By investing in companies from different countries, you can spread out this risk and potentially earn higher returns.

In conclusion, shaking up your investments is a key strategy for diversifying your investment portfolio and maximizing your potential returns. By considering alternative investments, emerging markets, different asset classes, industries, and geographic regions, you can protect your portfolio from risk and potentially earn higher returns. So don’t be afraid to shake things up and try new investment opportunities – your portfolio will thank you for it.

Embrace Diversity in Your Portfolio

When it comes to investing, the old saying don’t put all your eggs in one basket couldn’t be more true. Embracing diversity in your portfolio is a key strategy to minimizing risk and maximizing returns. By spreading your investments across different asset classes, industries, and geographic regions, you can protect yourself from market volatility and ensure that you have the opportunity to benefit from multiple sources of growth.

One of the main reasons to embrace diversity in your portfolio is to reduce risk. If you have all of your money invested in one stock or sector, you are putting yourself at the mercy of that particular investment. If something were to happen to that company or industry, your entire portfolio could be at risk. However, by diversifying your investments, you spread that risk across different assets, making it less likely that a single event will have a significant impact on your overall portfolio.

In addition to reducing risk, embracing diversity in your portfolio can also help you take advantage of different market trends and opportunities. Different asset classes tend to perform differently under various market conditions, so by diversifying your investments, you can ensure that you are well-positioned to benefit from whatever the market throws your way. For example, during times of economic uncertainty, investments in bonds or gold may perform well, while during times of economic growth, stocks or real estate may be the better option.

Furthermore, embracing diversity in your portfolio can help you achieve a more balanced and stable return over the long term. By investing in a mix of assets with different risk profiles, you can create a portfolio that is better equipped to weather the ups and downs of the market. This can help smooth out the overall performance of your investments and reduce the impact of market volatility on your portfolio.

So how can you embrace diversity in your portfolio? One way is to invest in different asset classes, such as stocks, bonds, real estate, and commodities. Each of these asset classes has its own unique characteristics and tends to perform differently under different market conditions, so by investing in a mix of them, you can reduce your overall risk.

Another way to diversify your portfolio is to invest in different industries or sectors. For example, if you have a lot of investments in technology companies, you may want to consider adding some investments in healthcare or consumer goods to balance out your portfolio. This way, if one sector experiences a downturn, you have other investments that may be able to offset any losses.

Finally, diversifying your portfolio geographically can also help reduce risk and increase returns. By investing in assets from different countries and regions, you can reduce your exposure to any one country’s economic or political issues. This can help protect your portfolio from events that may only impact one region, such as a recession or currency devaluation.

In conclusion, embracing diversity in your portfolio is a smart strategy for investors looking to minimize risk and maximize returns. By spreading your investments across different asset classes, industries, and geographic regions, you can create a more resilient and balanced portfolio that is better equipped to weather the ups and downs of the market. So don’t be afraid to mix it up and diversify your investments – your future self will thank you for it.

Diversifying Your Portfolio: How to Invest in Different Assets