Finding the Sweet Spot: Balancing Risk and Reward

Investing can be a daunting task for many people. The idea of putting your hard-earned money into something that may or may not pay off can be scary. However, with the right knowledge and strategy, investing can be a rewarding experience that can help you achieve your financial goals. One key aspect of successful investing is finding the sweet spot – the perfect balance between risk and reward.

When it comes to investing, there is always a trade-off between risk and reward. The higher the potential return on an investment, the higher the risk involved. On the other hand, investments with lower risk typically offer lower potential returns. Finding the sweet spot means finding the perfect balance between these two factors.

One way to find the sweet spot is to assess your risk tolerance. Everyone has a different comfort level when it comes to taking risks with their money. Some people are willing to take on more risk in exchange for the possibility of higher returns, while others prefer to play it safe and stick to low-risk investments. Understanding your own risk tolerance is key to finding the right balance for your investment portfolio.

Diversification is another important factor in finding the sweet spot. By spreading your investments across different asset classes, industries, and geographic regions, you can reduce the overall risk in your portfolio. Diversification can help protect your investments from the ups and downs of individual markets or sectors, and can help you achieve a more stable and consistent return over time.

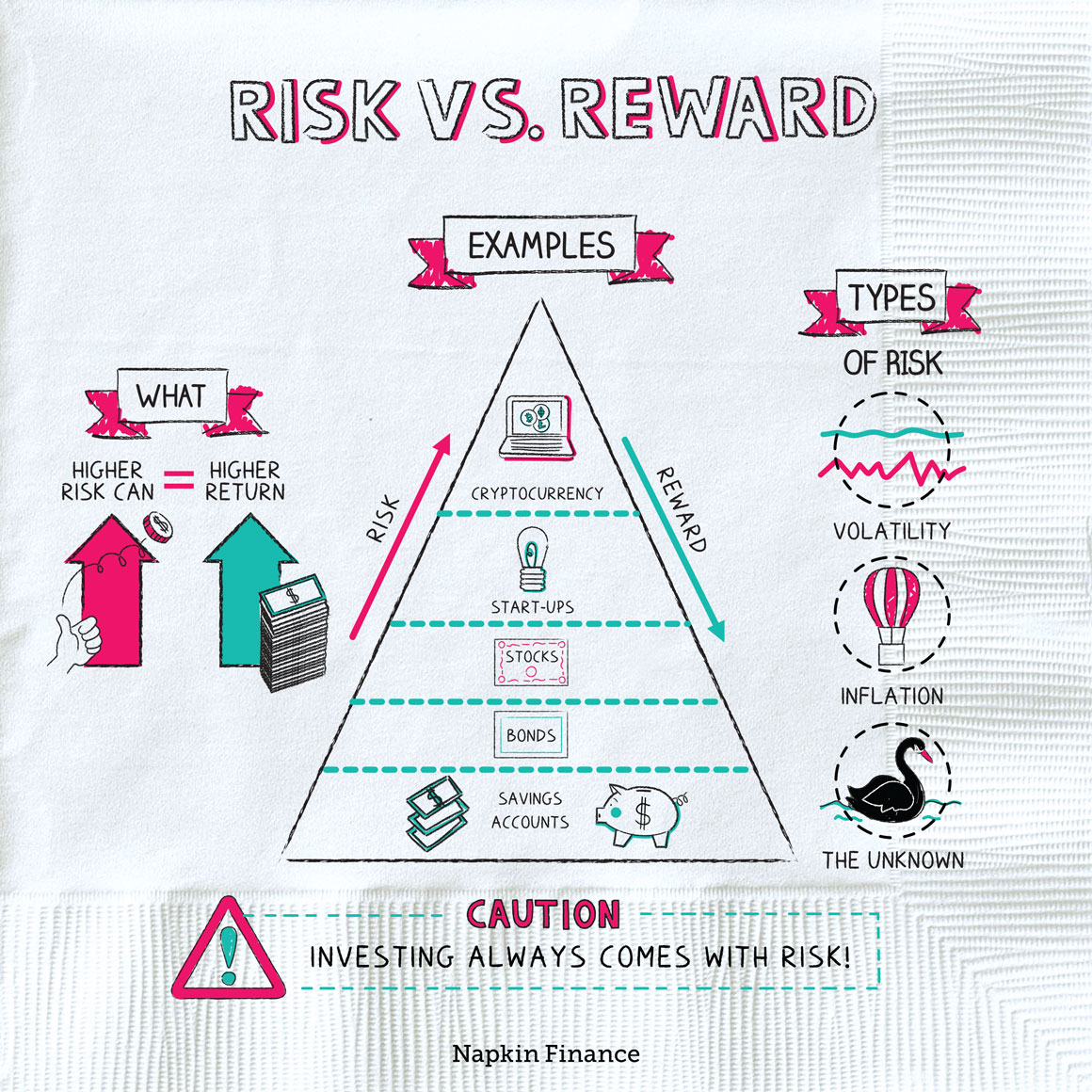

Image Source: napkinfinance.com

Another key aspect of finding the sweet spot is doing your research. Before making any investment decisions, it’s important to thoroughly research the potential risks and rewards of the investment. This may involve studying the performance of the investment in the past, analyzing market trends, and seeking advice from financial professionals. By arming yourself with knowledge, you can make more informed decisions and increase your chances of finding the sweet spot.

It’s also important to regularly review and adjust your investment portfolio to ensure that you are still on track to finding the sweet spot. Market conditions can change rapidly, and what may have been a good investment choice in the past may no longer be the best option. By staying vigilant and making adjustments as needed, you can ensure that your portfolio continues to strike the right balance between risk and reward.

In conclusion, finding the sweet spot when it comes to investing is all about balancing risk and reward. By understanding your own risk tolerance, diversifying your portfolio, doing thorough research, and regularly reviewing your investments, you can increase your chances of making smart investment choices that will help you achieve your financial goals. So don’t be afraid to take the leap into the world of investing – with the right approach, you can find the perfect balance and reap the rewards.

Navigate the Investment Jungle with Confidence

Investing can often feel like navigating through a dense jungle, with various paths and potential risks lurking at every turn. However, with the right tools and knowledge, you can confidently make your way through the investment jungle and come out on top.

When it comes to making smart investment choices, it’s essential to balance risk and reward. This means understanding the potential risks involved in any investment opportunity, while also keeping an eye on the potential rewards that could come your way.

One of the key ways to navigate the investment jungle with confidence is to do your research. This means staying up-to-date on market trends, understanding the different types of investments available, and seeking advice from financial experts. By arming yourself with knowledge, you can make more informed decisions and reduce the overall risk of your investments.

Another important aspect of navigating the investment jungle is diversification. Instead of putting all your eggs in one basket, consider spreading your investments across different asset classes. This can help reduce your overall risk exposure and protect your portfolio from fluctuations in any one market.

It’s also crucial to set clear investment goals and stick to a long-term strategy. By defining your objectives and staying disciplined in your approach, you can avoid making impulsive decisions based on short-term market fluctuations. Remember, investing is a marathon, not a sprint.

When it comes to choosing specific investment opportunities, always consider the risk-return tradeoff. Higher returns typically come with higher risks, so it’s important to assess whether the potential rewards are worth the potential downsides. Remember, there is no such thing as a risk-free investment, so always be prepared for some level of uncertainty.

In the investment jungle, it’s also essential to stay flexible and adapt to changing market conditions. Just as a jungle is constantly evolving, so too is the world of investments. Keep a close eye on your portfolio, adjust your strategy as needed, and be prepared to take advantage of new opportunities as they arise.

Finally, don’t forget the power of patience and perseverance. Building a successful investment portfolio takes time, dedication, and a willingness to ride out the ups and downs of the market. Stay focused on your long-term goals, stay the course, and trust in your ability to navigate the investment jungle with confidence.

In conclusion, navigating the investment jungle with confidence requires a combination of knowledge, discipline, and a willingness to take calculated risks. By staying informed, diversifying your portfolio, setting clear goals, and staying adaptable, you can make smart investment choices that balance risk and reward. So, grab your compass, put on your explorer hat, and venture into the investment jungle with confidence. Happy investing!

Risk vs. Reward: Choosing the Right Investment Strategy